A Texas refinery manager watches real-time AI alerts: "Compressor C-401 failure predicted in 72 hours—vibration patterns match bearing degradation." The maintenance team schedules intervention during planned downtime, avoiding $2.8M in lost production. This is Manufacturing 6.0 AI transforming USA oil & gas operations.

Manufacturing 6.0 deploys autonomous AI systems that predict, optimize, and self-correct in real-time. For USA oil & gas facing aging infrastructure, labor shortages, and stricter EPA regulations, Manufacturing 6.0 AI is essential.

Manufacturing 6.0 AI Solutions for USA Oil & Gas: Predictive Maintenance & Production Optimization

On-Premise AI Platform for Refineries, Pipelines, Drilling Operations & Offshore Platforms

92%

Failure Prediction Accuracy

$4.2M

Average Annual Savings per Site

18-24hrs

Early Warning Time

Zero

Data Leaves Your Site

What is Manufacturing 6.0 for USA Oil & Gas Operations?

Manufacturing 6.0 combines AI autonomy, edge computing, and industrial operations—purpose-built for oil & gas challenges: aging infrastructure, remote locations, safety-critical environments, and regulatory compliance.

Industry 4.0

Connected SCADA systems, IoT sensors, cloud dashboards

Reactive alerts, human decision-making required

Industry 5.0

Human-robot collaboration, digital twins, advanced analytics

Still requires expert interpretation

Manufacturing 6.0

Autonomous AI prediction, self-optimizing systems, zero-latency decisions

Prevents failures before symptoms appear

Manufacturing 6.0 AI for Oil & Gas: Core Capabilities

Predictive Failure Detection

AI analyzes 200+ sensor data points per second—detects bearing failures, valve degradation, corrosion patterns 18-72 hours before failure

Real-Time Production Optimization

Autonomous adjustment of flow rates, temperatures, pressures—maximizes throughput while maintaining safety parameters

Pipeline Integrity AI

Computer vision + ultrasonic analysis detects micro-cracks, corrosion, third-party interference across 1,000+ miles of pipeline

On-Premise Deployment

Zero data transmission to cloud—all AI processing at edge/site level. Full compliance with CISA, FERC, EPA data sovereignty requirements

Safety & Compliance Monitoring

Real-time PPE detection, gas leak identification, unauthorized access alerts—automatic incident reporting to OSHA/EPA systems

ESG & Emissions Tracking

Continuous monitoring of methane leaks, flaring efficiency, water usage—automated reporting for EPA, SEC Climate Disclosure Rules

Assess Your Oil & Gas AI Readiness

Get customized analysis for YOUR operations—refineries, pipelines, drilling sites, or offshore platforms. Includes current asset assessment, AI deployment roadmap, and 3-year cost-benefit analysis.

Real ROI: Manufacturing 6.0 AI Cost Savings

Actual Results from USA Oil & Gas Operations

Unplanned Downtime Reduction

-64%

Maintenance Cost Savings

$3.2M/year

Production Throughput Increase

+7.3%

Total Annual Benefit

$4.8M

Leak Detection Time

-89%

Prevented Spill Costs

$18M saved

EPA Violations

Zero in 2 years

Total Annual Benefit

$6.4M

Manufacturing 6.0 AI Investment Breakdown

Initial Investment (Year 1)

On-Premise AI Hardware

$380K - $520K

Software Licensing (perpetual)

$180K - $240K

Integration & Deployment

$120K - $180K

Training & Change Management

$60K - $90K

Total Year 1 Investment

$740K - $1.03M

Ongoing Costs (Year 2+)

Annual Support & Updates

$42K - $65K/yr

System Monitoring

$28K - $45K/yr

Model Retraining

$18K - $32K/yr

Infrastructure Maintenance

$12K - $22K/yr

Total Annual OPEX

$100K - $164K

Average Payback Period

7-11 months

3-Year ROI

420-680%

5-Year Net Benefit

$14M - $22M

Manufacturing 6.0 AI Use Cases for Oil & Gas Operations

Priority Use Cases by Operation Type

Refineries & Processing Plants

Rotating Equipment Predictive Maintenance

Compressors, pumps, turbines—predict bearing failures, impeller damage, seal degradation 24-72 hours in advance

-68% unplanned downtime

$2.4M avg. savings/year

Process Optimization AI

Real-time optimization of distillation columns, catalytic crackers, heat exchangers—maximize yield, minimize energy

+4-9% throughput

-12% energy costs

Flare & Emissions Monitoring

Continuous tracking of flaring efficiency, methane leaks, VOC emissions—automated EPA reporting

100% EPA compliance

Pipelines & Midstream

Pipeline Integrity Management

AI-powered leak detection, corrosion mapping, third-party interference alerts—real-time monitoring across entire network

-91% detection time

Zero major spills

Compressor Station Optimization

Predict valve failures, optimize compression ratios, balance loads across stations—minimize fuel consumption

-18% fuel costs

+94% uptime

Smart Pig Run Analysis

AI interpretation of inline inspection data—prioritize repair locations, predict growth rates of defects

-62% false positives

Drilling & Production

Drilling Optimization AI

Real-time rate of penetration optimization, stuck pipe prediction, bit wear analysis—reduce non-productive time

-34% drilling time

ESP & Artificial Lift Monitoring

Predict pump failures, optimize run life, prevent downhole equipment losses—maximize production uptime

+127 days avg. run life

Safety & PPE Compliance

Computer vision monitoring—detect missing PPE, unauthorized access, hazardous conditions

-88% safety violations

Offshore Platforms

Subsea Equipment Monitoring

Predict failures in subsea trees, manifolds, umbilicals—optimize intervention vessel scheduling

-79% equipment failures

Platform Structural Health

Continuous monitoring of jacket legs, risers, topsides—detect fatigue cracks, corrosion before critical failure

+97% inspection confidence

See Manufacturing 6.0 AI in Action

Schedule live demo using YOUR operational data. Watch AI detect real anomalies, predict failures, and optimize production in real-time.

On-Premise AI Architecture for Oil & Gas

Why On-Premise Deployment for Oil & Gas?

On-Premise AI (Recommended)

Data Sovereignty: Zero data transmission off-site—critical for FERC, CISA, TSA Pipeline Security, state regulations

Latency: <5ms inference time—essential for real-time safety shutdowns, process control

Reliability: Works during internet/cellular outages—remote sites, offshore platforms remain operational

Security: Air-gapped systems possible—no external attack surface for critical infrastructure

Cost: Predictable CAPEX model—no per-GB data egress fees, no bandwidth costs

Compliance: Meets NIST 800-82, IEC 62443, API 1164—built for industrial control systems

Best for: Production facilities, pipelines, offshore platforms

Cloud AI (Limited Use Cases)

Data Transfer: Regulatory risks with sensitive operational data leaving USA

Latency: 150-400ms round-trip—unacceptable for safety-critical real-time decisions

Dependency: Production stops during connectivity issues—common in remote oil fields

Attack Surface: Internet-exposed endpoints—higher cybersecurity risk for critical infrastructure

Costs: Unpredictable—data egress fees escalate with high-frequency sensor data

Compliance: Complex—requires additional controls for FERC, CISA, state pipeline regulations

Best for: Corporate analytics, training models, non-critical dashboards

Manufacturing 6.0 AI Technology Stack

Edge Hardware Layer

NVIDIA IGX Orin (Industrial GPU)

Ruggedized Edge Servers

Industrial IoT Gateways

Sensor Integration Modules

AI/ML Engine Layer

TensorFlow/PyTorch Models

Time-Series Forecasting

Computer Vision (OpenCV)

Anomaly Detection Algorithms

Data Processing Layer

Real-Time Stream Processing

Time-Series Database (InfluxDB)

Data Normalization Engine

OPC-UA/MQTT Integration

Application Layer

Predictive Maintenance Dashboard

Production Optimization UI

Safety & Compliance Portal

Mobile Alerts & Notifications

Integration Layer

SCADA/DCS Integration

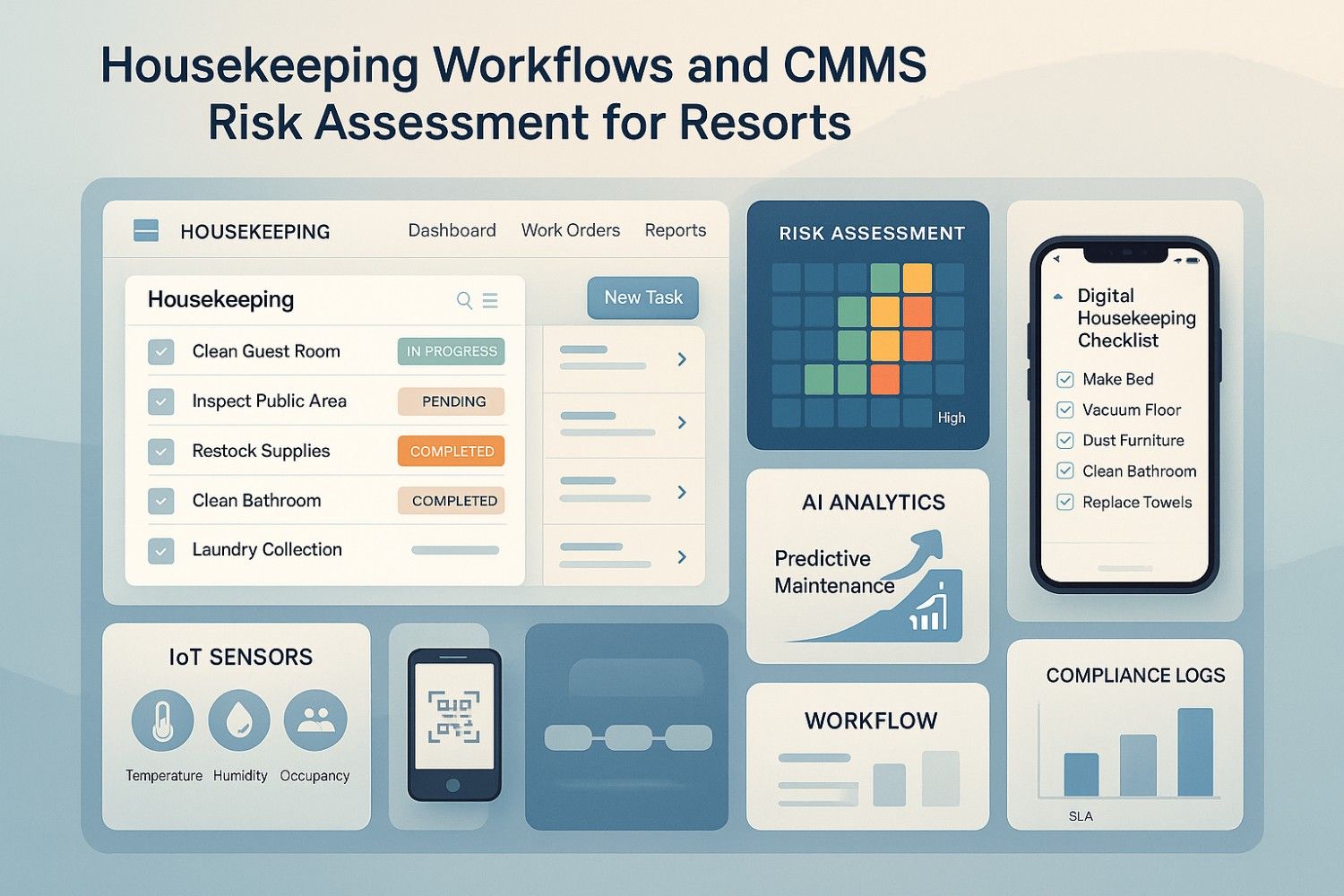

ERP/CMMS Connectors

Historian Data Sync

Regulatory Reporting APIs

Seamless Integration with Existing Systems

SCADA/DCS: Honeywell, Emerson DeltaV, Yokogawa, Schneider Electric

Historians: OSIsoft PI, AspenTech IP.21, GE Proficy

CMMS: SAP PM, IBM Maximo, Infor EAM, OxMaint

ERP: SAP S/4HANA, Oracle, Microsoft Dynamics

Safety Systems: Honeywell Safety Manager, Emerson Ovation

Regulatory: EPA e-Reporting, PHMSA Portal, State Systems

Compliance & Safety Benefits for USA Oil & Gas

Federal Regulatory Compliance

EPA Clean Air Act (CAA)

Automated emissions monitoring, flaring tracking, methane leak detection—real-time alerts for exceedances

OSHA Process Safety Management (PSM)

Continuous safety system monitoring, automated incident reporting, digital audit trails for inspections

PHMSA Pipeline Safety Regulations

Integrity management data tracking, leak detection compliance, automated PHMSA portal reporting

FERC & CISA Critical Infrastructure

On-premise deployment, air-gapped options, meets cybersecurity requirements for critical energy infrastructure

SEC Climate Disclosure Rules (2024)

Scope 1/2/3 emissions tracking, ESG metrics dashboards, automated SEC Form 10-K data generation

Safety & Risk Management

Real-Time PPE Detection

Computer vision identifies missing hard hats, safety glasses, FR clothing, respirators—instant alerts to supervisors

Gas Leak Detection AI

Continuous monitoring of H2S, methane, VOCs—automatic shutdown triggers, evacuation protocols

Predictive Safety Alerts

AI identifies patterns leading to incidents—prevents accidents before they occur

ESG & Sustainability Tracking

Methane Emissions: Continuous monitoring with 0.01% detection threshold—exceeds EPA standards

Flaring Efficiency: Real-time combustion efficiency tracking—optimize to >98% destruction efficiency

Energy Intensity: Monitor kWh per barrel produced, optimize to reduce carbon footprint

Automated ESG Reporting: Generate CDP, SASB, GRI, TCFD reports ready for investor scrutiny

Is Manufacturing 6.0 AI Right for Your Operation?

Answer These 3 Questions

1

What's your current unplanned downtime rate?

>15% unplanned downtime? High priority for AI predictive maintenance—typical ROI payback in 6-9 months

8-15% downtime? Strong candidate—focus on critical equipment first (compressors, pumps, turbines)

<8% downtime? Still valuable for production optimization, safety, compliance use cases

2

How old is your infrastructure?

>30 years old? Immediate need—aging assets have highest failure rates, benefit most from predictive AI

15-30 years? Optimal timing—implement AI before failure patterns accelerate

<15 years? Lower urgency but still beneficial for baseline performance tracking

5

What's your annual maintenance + downtime cost?

>$10M/year? AI pays for itself in <6 months—typical 40-60% reduction in total costs

$5-10M/year? Strong business case—12-18 month payback, $3-5M annual savings

<$5M/year? Still worthwhile—start with highest-impact use cases (safety, critical equipment)

Manufacturing 6.0 AI Readiness Assessment

High Priority (3-5 High Priority Answers)

Immediate implementation recommended. Schedule technical assessment within 2 weeks. Expected payback: 6-11 months.

Strong Candidate (2-3 High Priority Answers)

Begin planning within 60 days. Start with pilot project on most critical assets. Expected payback: 12-18 months.

Future Opportunity (0-1 High Priority Answers)

Monitor for 6-12 months. Focus on targeted use cases (safety, compliance, ESG). Expected payback: 18-24 months.

Get Your Customized AI Roadmap

Take our 10-minute Manufacturing 6.0 AI Assessment—receive personalized use case priorities, estimated ROI, and implementation timeline.

Key Takeaways: Manufacturing 6.0 AI for USA Oil & Gas

- 92% prediction accuracy for equipment failures 18-72 hours in advance

- $4.2M average annual savings per site through reduced downtime and optimized maintenance

- 7-11 month payback period—initial investment pays for itself in first year

- On-premise deployment essential—data sovereignty, low latency, FERC/CISA compliance

- Proven results—Texas refineries, Midwest pipelines, Gulf platforms, Permian Basin drilling

Start Your Manufacturing 6.0 AI Journey

Schedule 30-minute consultation with our oil & gas AI specialists. We'll assess your operations, identify highest-ROI use cases, and provide customized deployment roadmap.